Generative AI In Fintech Market Growth & Trends

The global generative AI in fintech market size is projected to reach USD 9.87 billion by 2030, according to a study conducted by Grand View Research, Inc. The market is estimated to grow at a CAGR of 36.1% from 2023 to 2030. The use of generative artificial intelligence (AI) for customized financial solutions is one prominent development. By examining massive data, generative AI models may produce customized investment suggestions, savings, and financial planning suggestions. This tendency aligns with the growing need for customized experiences and the desire to maximize financial results based on unique objectives and conditions. Combining generative AI with behavioral finance is another growing trend in the market. To better understand user demands and enable the delivery of highly customized financial goods and services, fintech businesses utilize generative AI to analyze client behavior, preferences, and trends.

The use of generative AI in fraud detection and prevention is one major trend; it examines large datasets to find patterns and anomalies suggestive of fraudulent activity. In addition, generative AI-driven chatbots improve customer service by offering individualized guidance and handling of financial duties. By enabling the examination of many data sources to create more precise lending decisions, generative AI has also enhanced risk assessment and underwriting procedures. In addition, generative AI is used for portfolio management and investment strategies, utilizing past market data to produce insights and optimize investment decisions.

Get a preview of the latest developments in the Generative AI In Fintech Market; Download your FREE sample PDF copy today and explore key data and trends

One of the key trends in the generative AI fintech market's compliance and fraud detection area is the creation of explainable AI models. Explainable AI is the capacity of AI systems to offer clear and concise justifications for their judgments and forecasts. The necessity for financial institutions to adhere to regulatory standards, build confidence, and guarantee responsibility in compliance and fraud detection procedures is what is driving this development. Explainable AI models for compliance and fraud detection assist in overcoming the difficulty of deciphering complicated AI algorithms and offer unmistakable insights into the variables affecting a decision. It offers the possibility for auditors, authorities, and compliance officers to comprehend and verify the logic underlying the results of AI-driven compliance and fraud detection.

Generative AI-powered solutions are used more often by European financial institutions to optimize investment strategies, improve client experiences, and streamline procedures. Consumers are increasingly interested in personalized financial services, which provide suggestions and insights based on their tastes and financial objectives and are powered by generative AI algorithms. In addition, generative AI supports compliance efforts by assisting financial institutions in navigating complicated regulatory environments and accurately identifying fraudulent activity. Generative AI is anticipated to foster innovation and reshape the European fintech business with the evolving changes and trends.

Generative AI In Fintech Market Report Highlights

- In terms of application, the compliance & fraud detection segment dominated the market in 2022 with a revenue share of 19.1%. Compliance and fraud detection in the fintech business are increasing due to the increasing complexity of financial transactions, the growing threat of cybercrime, and the need for regulatory adherence to assure confidence and security in the digital financial ecosystem

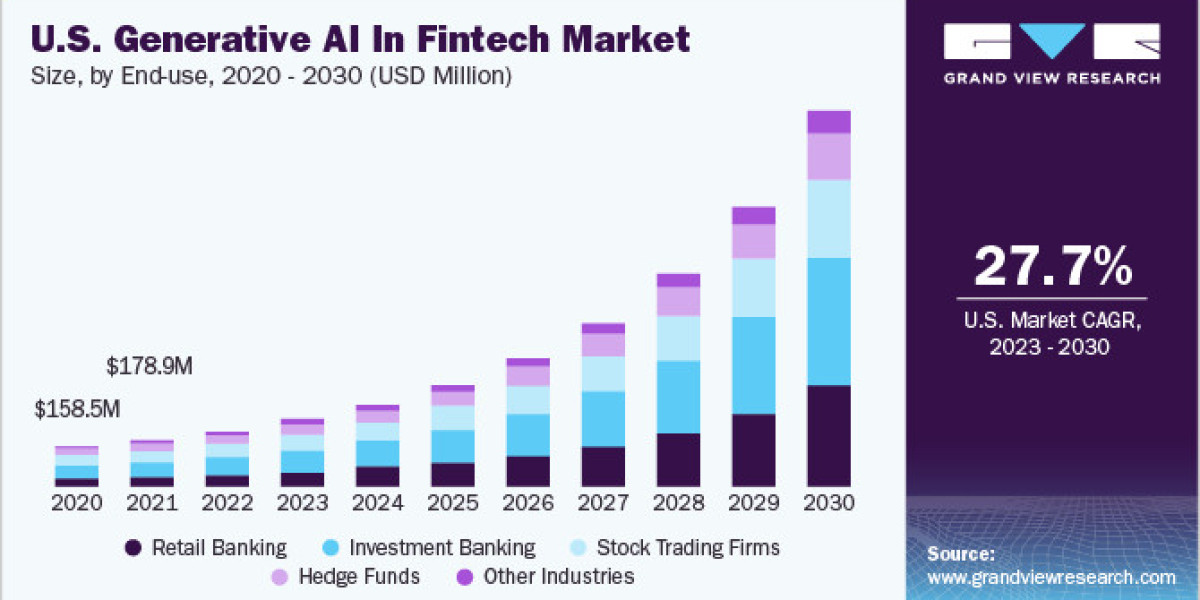

- In terms of end-use, the investment banking segment dominated the market in 2022 with a market share of 30.3%. Investment banks are adopting generative AI to simplify their processes and gain an advantage over rivals. These AI-driven systems can analyze big datasets, produce insightful results, and automate challenging financial modeling activities

- In terms of deployment, the on-premises segment dominated the market in 2022 with a revenue share of 60.0%. Many financial organizations choose on-premises deployment of generative AI in fintech solutions for various reasons, including data security concerns, regulatory compliance requirements, and increased control over their systems

- In terms of component, the service segment is estimated to register the highest CAGR of over 38% over the forecast period. The fraud detection and risk management service sector is experiencing a substantial movement towards AI-driven anomaly detection in the generative AI-powered fintech industry. Fintech organizations use generative AI algorithms to analyze enormous volumes of transactional and behavioral data to spot strange patterns and dubious behavior that might be signs of fraud or high-risk behavior

- In terms of region, owing to numerous top fintech companies and the adoption of advanced technology, notably in the U.S. market, North America dominate the market in 2022 with the largest revenue share of over 34%

Generative AI In Fintech Market Segmentation

Grand View Research has segmented the global generative AI in fintech market based on component, deployment, application, end-use, and region:

Generative AI in Fintech Component Outlook (Revenue, USD Million, 2017 - 2030)

- Service

- Software

Generative AI in Fintech Deployment Outlook (Revenue, USD Million, 2017 - 2030)

- On-premises

- Cloud

Generative AI in Fintech Application Outlook (Revenue, USD Million, 2017 - 2030)

- Compliance & Fraud Detection

- Personal Assistants

- Asset Management

- Predictive Analysis

- Insurance

- Business Analytics & Reporting

- Customer Behavioral Analytics

- Others

Generative AI in Fintech End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Retail Banking

- Investment Banking

- Stock Trading Firms

- Hedge Funds

- Other Industries

Generative AI in Fintech Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Mexico

- Brazil

- Middle East and Africa

- Kingdom of Saudi Arabia (KSA)

- UAE

- South Africa

Curious about the Generative AI In Fintech Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.