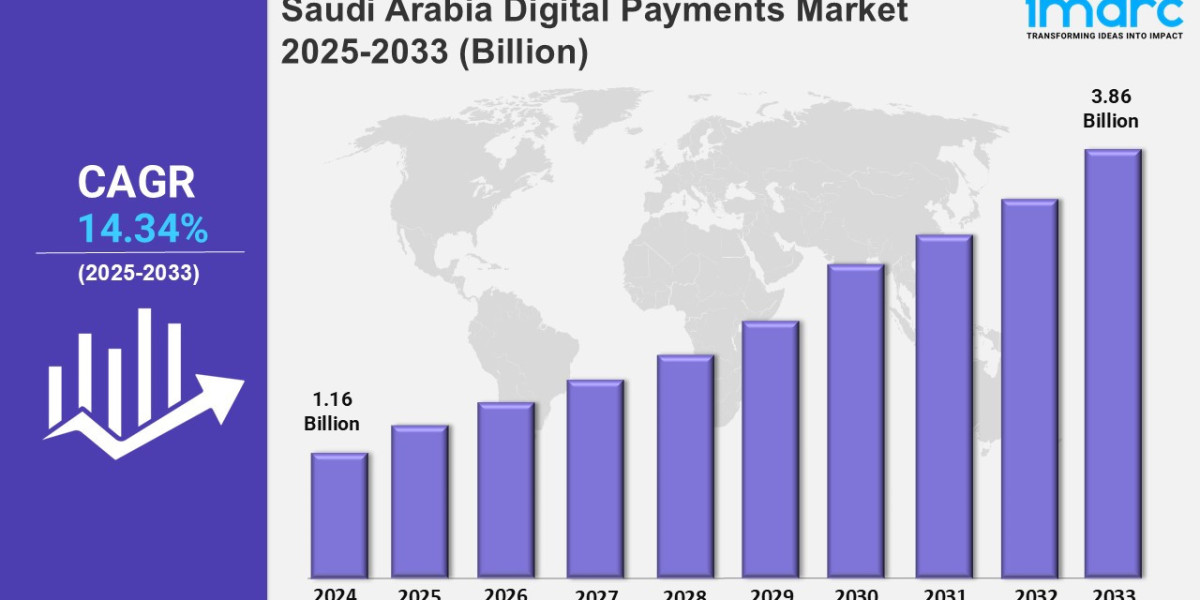

Saudi Arabia Digital Payments Market Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2025: USD 1.16 Billion

Market Forecast in 2033: USD 3.86 Billion

Market Growth Rate: 14.34% (2025-2033)

The Saudi Arabia digital payments market size reached USD 1.16 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.86 Billion by 2033, exhibiting a growth rate (CAGR) of 14.34% during 2025-2033.

Saudi Arabia Digital Payments Market Trends:

The Saudi Arabian market for digital payments has been in a process of transformation due to the Vision 2030 initiative, a program by the government aimed at diversifying the economy and reducing the country's dependence on oil revenues. A key aspect of the Vision 2030 project is that it promotes a cashless society, making it easier for people to pay digitally across different business sectors. The soaring of e-commerce, in conjunction with the surge of internet connections and mobile telephones, has largely contributed to the development of digital payments.

As people are getting more and more attracted to online shopping, the retailers must make sure that their payment systems are safe, efficient, and convenient. This phenomenon is additionally resulting from the increasingly expanding use of digital wallets, mobile banking, and contactless payment options, which are likewise being accepted among both parties, businesses, and customers. The government's goal of incorporating financial services and the implementation of a dynamic digital infrastructure are the other essential factors contributing to a positive environment for digital payments that are now in place.

Saudi Arabia Digital Payments Market Scope and Growth Analysis:

Besides consumer behaviour, the regulatory landscape in Saudi Arabia is maturing to encourage the digital payments ecosystem. The Saudi Central Bank (SAMA) has rolled out a number of programs to control and innovate fintech technology, which ensures the safety and credibility of digital transactions. The liberalization of open banking regulations and the issuance of new fintech licenses have further gathered speed towards the acceptance of digital money transfer solutions. Enterprises have progressively begun scheming digital payment alternatives into their infrastructure, and in so doing, they have realized the advantages of transaction speed, savings in operation costs, and elevated customer experiences. additionally, the COVID-19 pandemic has played an active role in accelerating the digital payment trend as consumers and businesses have turned towards safer contactless means of cashless payment. In conclusion, the digital payments market in Saudi Arabia is set to become a market for continuous growth, thus a more inclusive and efficient financial ecosystem being developed through innovation and collaboration between the involved stakeholders.

Download sample copy of the Report: https://www.imarcgroup.com/saudi-arabia-digital-payments-market/requestsample

Saudi Arabia Digital Payments Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the Saudi Arabia digital payments market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Component Insights:

- Solutions

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security and Fraud Management

- Transaction Risk Management

- Others

- Services

- Professional Services

- Managed Services

Payment Mode Insights:

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Others

Deployment Type Insights:

- Could-based

- On-premises

End Use Industry Insights:

- BFSI

- Healthcare

- IT and telecom

- Media and Entertainment

- Retail and E-commerce

- Transportation

- Others

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern region

- Southern Region

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant. Additionally, the report features detailed profiles of all major companies in the Saudi Arabia digital payments industry.

Other Key Points Covered in the Report:

- COVID-19 Impact on the Market

- Porter's Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145